Futarchy: A Beginner’s Guide to a New Way of Making Decisions

(The speakers in the above podcast audio are AI-generated by NotebookLM with this article as the source material. It's pretty fascinating to me how AI podcast can sound humanlike with all the breathing and other natural sounds.)

Imagine a world where decisions—whether for a country, a company, or a community—are made not just by voting, but by betting on what will work best. This is the core idea behind futarchy, a governance system that combines democracy with market predictions to choose policies. While traditional governance relies on elected leaders or majority votes, futarchy uses prediction markets to decide which policies are most likely to achieve the goals people care about, like economic growth or community well-being. For someone unfamiliar with how groups make decisions, futarchy might sound complex, but at its heart, it’s about making smarter, more informed choices by tapping into the wisdom of the crowd. In this introductory deep dive, we’ll break down what futarchy is, how it works, its potential benefits and challenges, and why it’s gaining attention in fields like blockchain and decentralised organisations.

What is Futarchy?

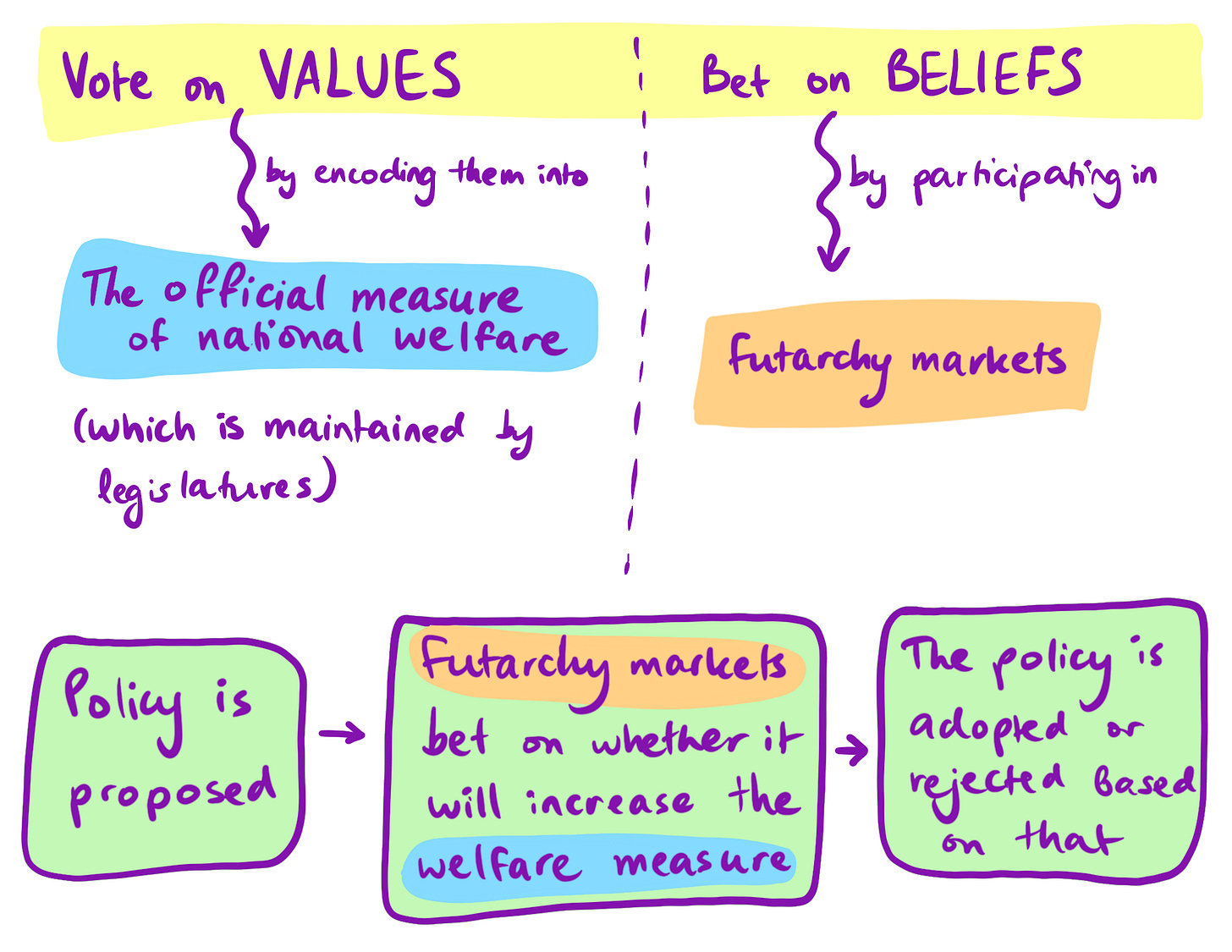

Futarchy is a governance concept introduced by economist Robin Hanson in 2000, blending democratic values with the power of prediction markets. In simple terms, futarchy lets people vote on what they want—like higher GDP or better healthcare—then uses markets to “bet” on which policies will best achieve those goals. A prediction market is like a stock market, but instead of buying shares in companies, people buy shares in outcomes—essentially betting on whether a policy will succeed or fail. The policy with the highest predicted chance of success, as determined by the market, is the one that gets implemented.

Think of it like choosing a restaurant: you decide you want Italian food (that’s your goal), then check reviews to find the best spot (that’s the market’s job). In futarchy, the community votes on their goal, then bets on the best way to get there. For example, a community might want to reduce traffic congestion. They’d vote to agree that less traffic is the goal, then propose two policies: building a new highway or increasing public transport funding. People would bet in a prediction market on which policy would better reduce congestion. If the market shows public transport funding has a higher chance of success, that policy would be chosen. Those who bet correctly might earn a reward, while those who bet on the losing policy wouldn’t lose money since their policy wasn’t implemented (Four Pillars, 2024).

Hanson’s idea came from his observation that democracies often struggle to make effective decisions because they don’t fully use the information available. In traditional democracy, people vote for leaders or policies based on promises, but those promises don’t always lead to the best outcomes. Futarchy aims to fix this by separating the “what” (the goal) from the “how” (the policy), letting markets figure out the best path forward (Hanson, 2014).

How Does Futarchy Work?

Futarchy operates in a few clear steps, making it a structured yet innovative way to govern. Imagine a sports team aiming to win a championship. The team agrees on the goal (winning), then debates strategies—like training harder or hiring a new coach. Here’s how futarchy works:

Set the Goal: The community or organisation votes on what they value most. This could be something measurable like national GDP, unemployment rates, or even community happiness scores. For example, a company might decide its goal is to increase profits by 10% in a year.

Propose Policies: Different ideas to achieve the goal are put forward. In the company example, one policy might be to launch a new product, while another could be to cut costs by reducing staff.

Open a Prediction Market: People bet on which policy will best achieve the goal. They buy shares in the outcome they believe in—if they think the new product will increase profits more, they bet on that. The market price of each policy reflects how confident people are in its success.

Choose the Winning Policy: The policy with the highest market-predicted chance of success is selected and implemented. If the new product policy has a higher market value, it’s chosen over cost-cutting.

Reward Accurate Predictions: After the policy is implemented, its success is measured against the goal. If profits do rise by 10% with the new product, those who bet on that policy might get a payout. If it fails, those who bet against it would win instead (Four Pillars, 2024).

This process leverages the “wisdom of the crowd”—the idea that a group of people, when betting with real stakes, can often predict outcomes better than a single expert. Prediction markets have been used successfully in other areas, like forecasting election results or box office earnings, and futarchy applies this logic to governance (Umbra Research, 2023).

Why Consider Futarchy? Benefits for Better Decision-Making

Futarchy offers several advantages that make it appealing, especially for those frustrated with traditional governance systems like democracy. First, it tackles a major problem in democracy: the lack of accountability. In many democracies, politicians make promises to win votes, but they’re often not held responsible for long-term outcomes, especially after their term ends. For example, a politician might increase government spending to gain popularity, leaving future generations to deal with the debt. Futarchy counters this by tying decisions to measurable results and incentivising better predictions through market bets (Four Pillars, 2024).

Second, futarchy can lead to more informed decisions. Prediction markets encourage people to research and think critically because their bets have real consequences. If you’re betting on a policy’s success, you’re motivated to dig into data, expert opinions, and potential risks, rather than just voting based on emotions or charisma. Studies have shown that prediction markets often outperform expert forecasts because they aggregate diverse perspectives (Umbra Research, 2023).

Third, futarchy aligns incentives. In traditional systems, leaders might prioritise short-term popularity over long-term benefits. In futarchy, participants have a financial stake in the outcome, so they’re more likely to focus on what will actually work. This can reduce the “populist” policies that sound good but don’t deliver results (Four Pillars, 2024).

Finally, futarchy is gaining traction in the blockchain world because it fits well with decentralised systems. Blockchain-based prediction markets, like Polymarket, allow for transparent, tamper-proof betting, making futarchy easier to test in a digital environment. Projects like MetaDAO on Solana are experimenting with futarchy to govern decentralised autonomous organisations (DAOs), showing how it can work in practice (Helius, 2024).

Challenges and Criticisms of Futarchy

Despite its promise, futarchy isn’t without challenges. One major concern is accessibility. Not everyone understands prediction markets or has the resources to participate, which could lead to a system where only the wealthy or well-informed have influence—a risk of “plutarchy” (rule by the rich). Hasu from Flashbots has warned that mass adoption of prediction markets might undermine democracy by amplifying the power of those with more money to bet (Four Pillars, 2024).

Another issue is manipulation. Prediction markets can be gamed if someone with enough money bets heavily to sway the outcome, even if their prediction isn’t accurate. This “self-dealing” problem could distort decisions, especially in smaller markets with less participation. There’s also a risk that those in power could tweak the system’s rules—like how success is measured—to favour their interests (Hanson, n.d.).

Additionally, futarchy relies on clear, measurable goals, but not all outcomes are easy to measure. For example, how do you quantify “happiness” or “social justice”? If the goal isn’t well-defined, the system might prioritise the wrong things or lead to unintended consequences (Lim, 2021).

Finally, futarchy is still largely untested at scale. While small experiments, like MetaDAO’s use of futarchy on Solana, have shown promise—with over 200 trades in three hours for its first decision market—scaling to a national level is a different challenge. Some argue it needs “one great success” to prove its worth, as seen with MetaDAO aiming to become a default governance platform for Solana projects within 18 months (Helius, 2024).

Futarchy in Action: The Blockchain Testing Ground

Blockchain technology has become a natural testing ground for futarchy because it offers a digital space where new governance ideas can be tried with less risk. Decentralised autonomous organisations (DAOs), which are community-run groups on the blockchain, are using futarchy to make decisions without traditional hierarchies. A DAO is like a club run by computer code, where members vote on how to spend the group’s money or resources. Futarchy helps DAOs make better decisions by using bets instead of just votes.

For instance, MetaDAO on Solana uses futarchy to decide on proposals, letting members bet on outcomes like whether a new feature will increase user adoption or boost the value of its $META token. In its first decision market, MetaDAO saw over 200 trades in just three hours, showing strong community interest (Helius, 2024). This has drawn attention from projects like Sanctum, which adopted MetaDAO’s futarchy model for its governance. MetaDAO’s structure involves submitting proposals via platforms like Discord, trading conditional tokens in “pass” or “fail” markets, and using a Time-Weighted Average Price (TWAP) oracle to decide outcomes after 10 days of trading (Helius, 2024).

Blockchain also solves some of futarchy’s practical challenges. Its transparency ensures bets are recorded fairly, and smart contracts can automate payouts, reducing the risk of manipulation. Platforms like Polymarket show how blockchain can make futarchy scalable and secure, encouraging more experimentation (Four Pillars, 2024). Ethereum’s early exploration of futarchy, as discussed by Vitalik Buterin, highlighted its potential for DAOs, where decentralised governance is crucial. In DAOs, where there’s no central authority, futarchy provides a way to make decisions that everyone can trust, since the markets are open and transparent (Buterin, 2014).

However, blockchain-based futarchy isn’t perfect. Participation rates can be low—MetaDAO sees 20 to 60 people trading a few hundred thousand dollars per proposal, which might not reflect a broad consensus (Helius, 2024). There are also concerns about market sentiment noise or reliance on TWAP oracles, which could be improved with better incentives for participation (Helius, 2024). Still, these experiments are a starting point, showing how futarchy might evolve as more people join in.

The Future of Futarchy: A New Path Forward?

Futarchy offers a bold vision for governance, one that prioritises results over rhetoric. By combining democratic values with market-driven predictions, it aims to make decisions more effective and accountable. For beginners, the key takeaway is simple: futarchy is about using bets to choose the best path to a goal, rather than relying on votes alone. While it’s not a perfect system—facing challenges like accessibility, manipulation, and scalability—it’s a promising idea, especially in the blockchain space where it’s being tested in real time.

As futarchy gains traction, it could inspire new ways to govern, not just for DAOs but for larger systems too. Imagine a city using futarchy to decide on public projects, or a company betting on strategies to boost growth. Hanson himself has speculated about dramatic scenarios, like a world government adopting futarchy to prevent civilisation collapse by tying decisions to widely shared goals (Hanson, n.d.). In organisations, futarchy could be particularly valuable for high-stakes decisions, where speculators can gather relevant information, or in dysfunctional systems like governments or charities (Hanson, n.d.).

The possibilities are vast, but so are the questions. Will futarchy truly fix the flaws of democracy, or will it create new problems? Some, like Hasu from Flashbots, see it as a potential threat to democracy, possibly leading to a system where wealth trumps votes (Four Pillars, 2024). Others, like MetaDAO’s Kollan House, argue it surfaces the best information, outperforming expert-driven systems (Four Pillars, 2024). Only time—and more experiments—will tell. For now, futarchy stands as a fascinating example of how innovation can rethink the way we make decisions, offering a glimpse into a future where governance is driven by data, not just votes.

If you’re curious to learn more, check out MetaDAO’s experiments or explore prediction markets like Polymarket to see futarchy’s building blocks in action.

References

Four Pillars. (2024, August 8). [Opinion] Can futarchy be the future of governance? X. https://x.com/FourPillarsFP/status/1821464139279294502

HackerNoon. (2020, November 16). Futarchy fixes democracy, or does it? https://hackernoon.com/futarchy-fixes-democracy-or-does-it-482l35s6

Hanson, R. (2014, August 21). Introduction to futarchy. Ethereum Blog. https://blog.ethereum.org/2014/08/21/introduction-futarchy

Hanson, R. (n.d.-a). Futarchy and self-dealing governance. Overcoming Bias.

Helius. (2024, February 3). Futarchy and governance: Prediction markets meet DAOs on Solana. https://www.helius.dev/blog/futarchy-and-governance-prediction-markets-meet-daos-on-solana

Umbra Research. (2023, September 15). Futarchy: A deep dive into prediction markets for governance. https://www.umbraresearch.xyz/writings/futarchy